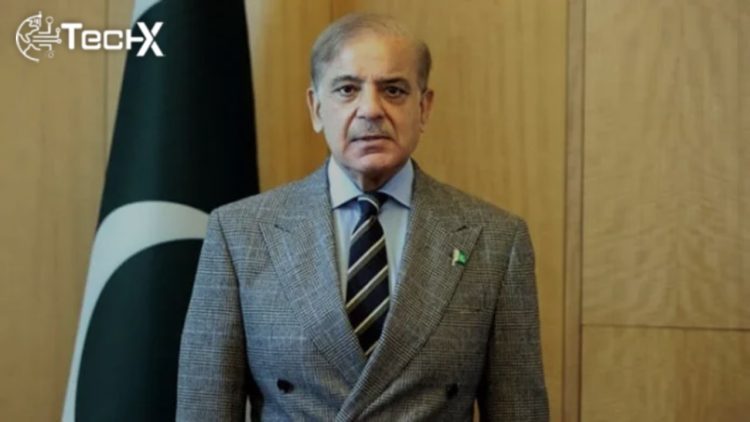

Prime Minister Shehbaz Sharif has delayed the implementation of a new tax incentive package for the real estate sector due to unresolved issues. The decision comes amid opposition from the Federal Board of Revenue (FBR) and concerns over compliance with International Monetary Fund (IMF) regulations. The proposed package aimed to boost the housing market but faces significant hurdles.

FBR Opposes Tax Amnesty Proposal

The FBR has strongly opposed a key proposal to grant first-time buyers of homes, shops, or offices a tax amnesty of up to Rs. 50 million. FBR Chairman Rashid Langrial argued that such a move would violate IMF conditions, which prohibit tax amnesties. The IMF has consistently discouraged policies that could undermine tax collection efforts and create fiscal imbalances.

Debate Over Tax Reductions

During a meeting of the housing sector task force, officials discussed reducing property transaction taxes and eliminating the 3 percent federal excise duty (FED) on real estate. While the FBR chairman supported removing the FED, some task force members warned that tax cuts might fuel speculative investments. This could destabilize the market and exacerbate existing challenges in the real estate sector.

Concerns Over Speculative Investments

Critics of the proposed tax cuts argue that they could encourage speculative activities rather than genuine housing demand. Speculative investments often lead to artificial price inflation, making housing less affordable for middle- and lower-income groups. The government must balance stimulating the real estate market with ensuring long-term stability and affordability for genuine buyers.

Also Read: President Emphasizes Pakistan’s Commitment to Chinese Technology

Interest Rate Subsidies Under Consideration

To support lower- and middle-income groups, the government is exploring interest rate subsidies for home loans. This measure aims to make housing more accessible and stimulate demand in the real estate market. However, its success depends on careful implementation to avoid unintended consequences, such as increased debt burdens for borrowers.

Challenges in Real Estate Regulation

The real estate sector in Pakistan remains largely unregulated, with agricultural land frequently converted into housing societies. Many of these developments lack proper approvals, leading to legal and regulatory issues. This lack of oversight has created a fragmented market, complicating efforts to implement effective reforms and ensure transparency.

Oversupply and Fraudulent Practices

The real estate market is also grappling with an oversupply of plots and widespread fraudulent sales of apartments and land. These issues undermine consumer confidence and hinder the sector’s growth. Addressing these challenges requires stricter regulations, improved oversight, and stronger enforcement mechanisms to protect buyers and restore trust in the market.

Balancing Growth and Stability

The government faces the dual challenge of stimulating the real estate sector while ensuring long-term stability. Tax incentives and subsidies could boost demand, but they must be carefully designed to avoid encouraging speculative behavior or violating IMF conditions. A balanced approach is essential to achieve sustainable growth and address the housing needs of the population.

IMF’s Role in Policy Decisions

The IMF’s restrictions on tax amnesties and exemptions have significantly influenced the government’s decision-making process. Compliance with IMF conditions is crucial for maintaining fiscal discipline and securing international support. However, these constraints limit the government’s ability to implement bold measures to revive the real estate sector.

Path Forward for Real Estate Reforms

To address the sector’s challenges, the government must prioritize comprehensive reforms. These include improving regulation, cracking down on fraudulent practices, and introducing targeted incentives for genuine buyers. Collaboration between stakeholders, including the FBR, real estate developers, and policymakers, will be key to achieving a balanced and sustainable real estate market.

Conclusion

The postponement of the real estate tax plan highlights the complexities of reforming Pakistan’s real estate sector. While tax incentives and subsidies could stimulate growth, they must be carefully crafted to avoid unintended consequences. Addressing regulatory gaps and ensuring compliance with IMF conditions will be critical to achieving long-term stability and meeting the housing needs of the population.