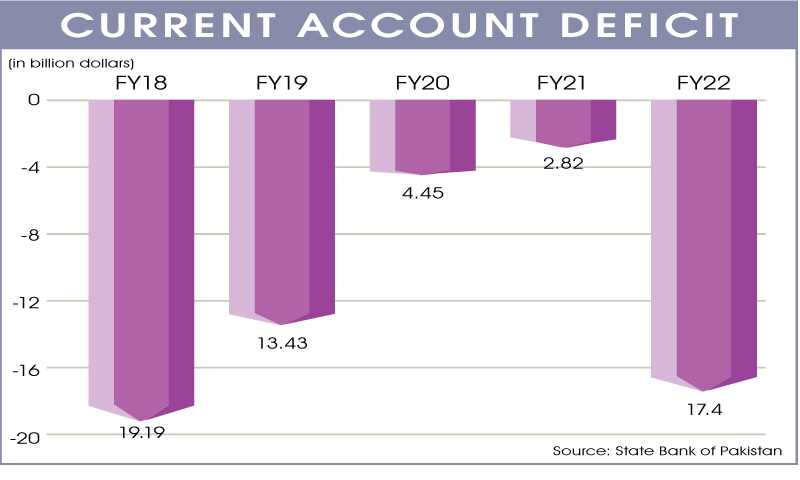

For an economy already struggling with significant imbalances, the current account deficit (CAD) grew to $17.4 billion in FY22, which could be the most devastating shock.

According to a study released on Wednesday by the State Bank of Pakistan (SBP), the country’s CAD increased to $17.406 billion in FY22 from just $2.82 billion in FY21.

The enormous CAD speaks volumes about the serious balance of payments issue.

The PML-N-led coalition government recorded its second-highest quarterly deficit of the fiscal year that concluded on June 30 with a CAD of $4.323 billion in the months of April and June 2021–22.

The above $17.4 billion deficit is especially painful in light of the lack of loan inflows and the commercial markets’ unwillingness to accept Pakistan’s bonds due to their increased risk.

The SBP’s forecast for the deficit in FY22 has been surpassed by the current account deficit. In FY22, the CAD grew from 0.8 percent of GDP to 4.6 percent.

The SBP published its Annual Report in November 2021 and stated that for FY22, the current account deficit is anticipated to be between 2 and 3 percent of GDP.

The IMF executive board must accept the staff-level agreement made on July 15 before Pakistan can unlock the dollar inflows, according to reports in both local and international media.

Although the finance minister has been teasing an early agreement with the IMF, the trust deficit is growing with time, and the currency market reflects this by daily devaluing the local currency.

The CAD for June FY22 was significantly greater than for May, increasing to $2.275 billion from $1.430 billion. The CAD was $1.637 billion in June FY21.

Poor inflows and larger outflows will make the current fiscal year difficult, and the rate of economic growth will be half of what it was in the prior fiscal year.

To read our blog on “May saw a $1.4 billion increase in the current account deficit,” click here.